Not all penny stocks are created equal 🪙

Revlon revs up as it prepares to exit bankruptcy!

Most penny stocks are small, random companies you’ve never heard of before. But what some people don’t realize is that there are a few gems buried in the OTC Market (Over The Counter) that are major corporations / recognized brands which means swinging them can be less risky that new startups or unknown companies.

Take for instance Revlon Inc which is a widely known makeup company that was delisted from the NYSE back on June 15, 2022 which moved it to the OTC Market and it’s price dropped into penny stock territory:

Not to say that there is zero risk — everything in the market is risky, especially these days — but $REVRQ made a Stage 1 Breakout today so I’m very interested in that and here’s why:

“A penny stock saved (from bankruptcy) is a penny earned.”

~Benjamin Franklin

Some recent news about Revlon exiting a bankruptcy claim has caused a spike in their share price:

You can today there was already a 14% move to the upside, which is huge, but also look at the size of that move… 9.6 cents!

Now look at the next Resistance level, about $0.99 which is a 22 cent move. That doesn’t sound like a lot, but remember, percentages are what’s really important!

In this case, a 22 cent move to the upside comes out to 28.5% gains! And the RSI is only at 54 (granted if you look at past data you see this stock doesn’t really ever go over 70 RSI so it’s important to factor in what is relatively considered “overbought” for this chart, which is about 62 RSI).

Now let’s also look at the 200 SMA, which is at $3.60 currently. Now this is a pie in the sky Target but if it were to hit that again that would equate to a 367% gain! Again, that is EXTREMELY best case scenario but what all this illustrates is what the draw to penny stocks is for traders.

Now that you understand the draw to penny stocks, you can gain the upper-hand by looking for reputable companies that have fallen into the penny stock zone.

This all sounds too good to be true, but remember the inverse also applies, so a 22 cent move to the downside results in 28.5% losses as well. So penny stocks, even recognizable companies, are still extremely risky and should be swung with caution.

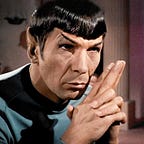

Hopefully this gives you some insight into the potential of penny stocks and adds a little bit of new knowledge to your swing trading repertoire. Don’t forget to follow SpockTradez on Twitter to get picks like these even sooner.

Trade long and prosper!

🖖

Sign Up for a Medium Membership: https://spocktradez.medium.com/membership