How I Swing Trade

Lesson 3: Risk Management

Manage your risk and profits will take care of themselves!

*NOTE: This is Lesson 3 in a series, CLICK HERE to read Lesson 2 if you haven’t already

We can never fully eliminate risk from trading — if we could, we’d all be billionaires. However, what we can do is minimize it the best we can in order to increase our chances of success. Even with a solid trading system, there’s always going to be trades that don’t go the way we hoped. It’s a fact. It’s gonna happen and the sooner you come to terms with that the better off you’ll be. Only after you’ve made peace with that fact will you understand the utter importance of Risk Management.

“Psychology is critical to successful trading — without the proper mindset, you will not prosper in your trading journey”

In my opinion, Risk Management is THE most important aspect of trading. Right now, you’re probably thinking, “Wait, hold up! If it’s the most important part of trading why is it Lesson 3??”

Because I know trading responsibly is the last thing a new trader wants to hear about but it’s something they need to know, learn, and abide by. Newbie traders are always eager to get trading and start making money; they don’t want to spend time hearing about avoiding risk because they think the bigger the risk the bigger the reward. But trading doesn’t have to be super risky to provide big rewards. Savvy traders know this. But beginners… you gotta let them make their own mistakes and then teach them how to avoid those mistakes in the future. This way they feel the sting of unmanaged risk and therefore the principles of Risk Management have a better chance of becoming ingrained habits.

It’s like telling a child a stove is hot to teach them not to touch it — people learn better when they feel the pain from a hot stove or the pain of a bad trade. It sears into you memory and forms into a reflex to avoid the discomfort you experienced before. Risk management may not be the sexiest topic when talking about trading but trust me, by the end of this lesson you’ll realize its importance.

What is the Risk?

Do you know what the riskiest element in a trading system is…?

It’s YOU!

You are your own worst enemy. More specifically: your emotions. Emotions have no place in trading systems. The system is there to circumvent your emotions because we all know where emotions like fear and anger lead to…

When we’re fearful or anger we rarely, if ever, make good decisions. So you must train yourself remove emotions from the equation.

Trade Without Emotions

That’s my mantra. Those are words to trade by, sear that concept in your mind!

Have you ever had someone give you a “hot stock tip” and when you asked them why that stock they simply say, “I have a good feeling about it.” Feelings have no place in trading. That whole philosophy is how I named this blog!

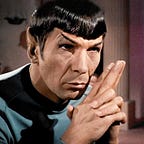

Spock is a Vulcan, they are a people of logic who have no use for emotions. Whereas Kirk is a human, brimming with a full spectrum of emotions.

Remember those Goofus and Gallant comics? Well, this is basically the super nerdy version of that.

Kirk gets angry when his trade hits its Stop Loss

Spock remains calm, knowing his Stop Loss has protected him from further losses

This mindset is all about letting your logic control your trading, not your emotions. Once you master this, your trading will reach the enlightened stage.

How to Manage Risk

RULE #1 is NEVER trade what you can’t afford

This is an absolute MUST FOLLOW for stock trading and it goes doubly or even triple so for cryptocurrencies. You should not be throwing your life saving into the market.

Only invest what you can afford to lose without that loss having any effect on your daily life in the foreseeable future.

When people trade with money they can’t afford to lose it calls their emotions to the surface. They begin to fear losing that money, they have anxiety about price moving against them, they get sad or angry when their position triggers its S/L. Start by trading with “play money” — that extra, unexpected, bonus cash that we all find ourselves with from time to time. Maybe it’s a birthday card from grandma, or a tax refund, or a prosperous garage sale. Whatever the case, new traders shouldn’t be putting in money that they can’t afford to lose. Treat it like a trip to Vegas, go in expecting that this money is already gone but you’re gonna have fun with it. DON’T take out a second mortgage to start your trading journey.

“Plan the trade and trade the plan”

I’ve said this before but it’s a crucial part of managing your risk. When you enter a trade you should know exactly what your Stop Loss is and your Target price (NOTE: this applies to trading, not investing — with investing you’re looking to buy a stock for a long term hold and just let it be).

If you follow your trading plan, you’ll know exactly how much risk you’re putting on with each trade. Don’t deviate from your plan when you see price nearing your S/L. Your stops are there to protect you from bigger loses, NEVER lower your stops, only raise them. Don’t call audibles, stick to your plan!

How much should you risk?

Professional traders typically do not risk more than 2% of their account on a single trade.

How much risk a trader can tolerate varies on a person to person basis, but in general:

You want to keep your risk between 0.5–2% of your total account based on how much you can afford to lose.

You might be thinking, “But that’s impossible! My account is only $2,000 so even at 2% risk, that limits me to $40?! What am I supposed to do, that won’t even buy me 1 share of $UBER! If I want to buy many shares, what can I buy with $40 that isn’t a crap penny stock??”

It doesn’t quite calculate like that. Which brings us to the nextpart of the Lesson…

Calculating Risk

One thing you have to remember is that quality stocks don’t just fall to zero!

If you buy 10 shares of Apple ($AAPL) at $125 you’re not actually risking $1,250 even though that’s how much of your equity is tied up in the trade. To calculate risk you must figure out how much you can potentially lose on the trade.

The simple equation is: Entry Price - Stop Loss price = $ Risk per share

Then take that amount x 100 and divide by your total account size to find the percent of your account at risk.

Taking the previous example, if you have 10 shares of $AAPL that you bought at $125 and based on your chart analysis have set your S/L to $120 you’re only risking $5 per share ($50 total)*. If your account size is $2,000 then that trade risk of $50 is 2.5% of your total equity. So in order to keep your risk under 2% you would want to only buy 8 shares instead of 10.

*NOTE: This might vary slightly due to slippage — so you’re Market Order S/L might not trigger exactly at $120 but it could be $119.96 or some other number that’s slightly off… OR… if it moved in the After Hours and then opens the next day at say $117, the S/L will trigger at that price.

To make all of this math easier, I’ve put together a FREE Google Sheet to help you calculate your % Risk, Risk to Reward ratio, and position size:

DOWNLOAD: SpockTradez Risk Calculator

Select File>Make Copy to save to your Google drive

I think I have all my math formulas correct on it, but you can also search the internet for more reliable ones.

Diversify Your Portfolio

“Diversification is the only free lunch on Wall Street.”

This is one of the basic tenants of trading & investing yet it is constantly overlooked or ignored by the beginner. In February and March of this year, a lot of traders were feeling the pain of not having a diverse portfolio.

Stocks in the same Sector tend to move together like a flock of birds or a school of fish. I’ve covered Sector rotation before so I won’t go into it again, but suffices to say you don’t want to be all in on Tech when money rotates out into another Sector.

No, you’re not diversified just because you have Tech Software stocks and Tech Hardware stocks and Tech Services stocks.

I know Tech is the hot thing right now, but don’t overlook the “boring” Sectors like Energy or Materials or Consumer Goods and Services. Remember, money doesn’t know where it comes from. $100 profit from $MMM is just as good as $100 profit from $TSLA — even if it’s not as “sexy.”

Having an unbalanced portfolio is like only going to the gym and working out your arms. Sure they might get swoll and look strong but what happens if you lose your arms? You’re SOL!

Also, you don’t want to diversify just amongst Sectors BUT ALSO Markets! Ever notice how the news always reports “The Dow Jones is down X number of points” or “The NASDAQ is up X number of points”? Well as Markets move, the stocks in them can move together as well. Remember when I talked about “The Wind”? All of those are additional collections of stocks that move up and down together.

There’s also diversifying in terms of other finical instruments i.e. bonds and crypto, but I won’t get into that now.

TWO QUALITIES OF A SUCCESSFUL TRADER :

Whenever I read (or listen to) interviews with successful traders, they’re often asked what qualities make a great trader and the answer is almost unanimously Discipline and Confidence.

#1 Discipline

“Breaking a system is like breaking a diet — when you do it once, it becomes easier to do the second time and so on…”

Discipline is probably the most important of the two. Without discipline, what good is confidence?

You need the discipline to stick to your trading system and trading plan. Not adhering to your own rules will cost you dearly. Your plan or trading system isn’t just there to make you money but also to prevent you from losing it. That’s actually the most important aspect of it. You need to run your portfolio like a business — starting a new business is about protecting the capital in order to keep the doors open, profit comes later.

When first considering a trade, don’t look at the potential profit you can gain but rather what is the potential loss that you can suffer. Keep your trades small until you get the hang of it, then begin to increase your positions size and therefore your risk. All of this takes discipline.

Lacking discipline will lead to things like:

- Jumping into a trade everyone is talking about, like the meme stocks, for no other reason than everyone is talking about them — these are referred to as “impulse buys”

*This type of scenario is the product of FOMO — Fear Of Missing Out. There’s another one of those words again — Fear, an emotion. It has no place in trading. - Impulsively taking a position in an unfamiliar stock based on a hunch, a hot tip from a friend, or flashy news only to later look at your portfolio and wonder why you bought this stock — these are referred to as “sugar trades”

- Watching the price dip a little bit and panic selling before it hits your S/L only to watch the stock bounce back up and perform exactly as you initially expected it would — this is a “panic sale”

- Watching on of the stocks you’re holding reach your target price but not taking profits because “it might go higher” and then you watch it drop back to where you got in so you sell at break even — these are called “popcorn trades”

Discipline keeps you on track and focused. Forming good habits take discipline but once learned, it become a muscle memory which allows you to act instinctively later on. It’ll become like your grandma’s cooking. She doesn’t use a recipe book, she’s got that shit down so well it’s just second nature! Being disciplined allows you to gain proficiency. That’s where you want to be with your trading and practicing discipline is the surefire way to get there.

One of the greatest disciplines, and also the hardest to form, I think, is not looking at your portfolio balance during the day. This leads to so much emotional trading — such as panic selling — that I recently found it best for my mental health, anxiety, and my wallet, to delete my trading app off my phone. I know it sounds crazy to not have the app on your phone in this day and age BUT I will say it’s resulting in more profit because it reduced my Risk of, well, me! I’ve found that having to log in through the browser on either my phone or computer gives me extra to time to really think about a trade and helps me avoid an impulse buy or a panic sale.

Be smart enough to know what you don’t know!

As a new trader, avoid shorting, options, forex, and god forbid trading on margin… these are enticing traps to a newbie trader, but you must exercise Discipline and avoid them when first starting out. The urge to jump into these arenas stems from Greed, another emotion that will get you into serious trouble. If you’re new to trading (I’d say less than 3 years) don’t worry about these branches of trading, they’re too big league for you right now. You need to learn to walk before you learn to scale Mt. Everest.

Avoid Style Drift!

One of the other biggest threats a lack of Discipline poses against your trading is “style drift.” Style Drift is when you are constantly changing trading systems. Today you are swing trading quality stocks, next week you’re a day trader dabbling in penny stocks. After that you give up on Technical Analysis and switch to Fundamental Analysis. No, no you’re an Elliot Wave trader… These are impulsive, emotional reactions to a trading system “not working” even though you haven’t given it any time to do its thing. It’s trading A.D.D. And trust me, style drift always leads to increased losses. You just keep digging yourself deeper into more and more holes. And at the end of the day, you wind up with one year of experience six times instead of six years worth of experience.

Understand, jumping styles is very different than making changes to custom tailor a trading system to fit your trading personality. Consider yourself on a trading journey, your trading system is like the map to your trading success. You can alter the course as you go and learn, but if you keep throwing away your map and starting over, you’ll never get anywhere.

Remember: Cash is a position!

I know once you start trading you’re full of excitement and just want to get out there and start trading. It becomes very addicting. So much so that new traders often feel that they HAVE to be trading every day — even when there aren’t any setups that fit their trading system. But if you obtain the proper Discipline, you can avoid this trap.

So remember: You don’t always have to be in the market. Cash is a position!

#2 Confidence

Confidence is the other quality of a successful trader. Confidence in your skills to find setups. Confidence in your trading system. And Confidence that over time you can make up for any losses.

Gain Confidence in your skills and trading system by first paper trading it for a while. Get to know your system and make adjustments that fir your style. Get to know how the stocks you’re tracking tend to move, see how the setups play out and take note of which did and did not pan out and try to figure out why they did moved the way they did. Make your early mistakes without putting your money on the line. This will train to you keep emotions on the sidelines.

You want to make sure you’re trading with Confidence and not Cockiness. What’s the difference? (Ask any woman who’s been hit on at a bar) Confidence is knowing you’re great but not needing to tell anyone that you are. Cockiness is a sort of false confidence, it’s the confidence of fools.

Cockiness is knowing deep down you’re not great, probably just mediocre at best, but thinking that acting like your great will convince others that you are. Cockiness is being your own hype man (or woman). Don’t be that person!

Back to the bar scenario — The guy the woman went home with was probably confident, the guy she ignored was probably cocky.

Don’t trade with scared money

Having Confidence in your skills and your system are key. If you’re trading with scared money (there’s those pesky emotions again- Fear) you’re only going to make mistake and further re-enforce your fears.

Confidence in trading is about having trust in your system and not letting losses get the better of you.

Lose the ego

A loss is not something to be embarrassed about or feel bad for taking. In other words, don’t let it bruise your ego. EVERY trader has losses, it’s just part of the game.

Think of it like a basketball player missing a shot, it’s gonna happen, nobody makes 100% of their shots. If they dwelled on every single shot they’d soon become overcome with so much fear and anxiety that they wouldn’t ever shoot again. Remember, you can miss a lot of shots but still win the game so check your ego at the door.

Take your losses with dignity — Two important guidelines for taking losses:

- Don’t make excuses for taking losses

- Take your losses quickly as possible

Own your mistakes — It’s the only way you’ll learn from them

Look at losses as an opportunity to learn something:

- Where did the trade go wrong?

- Did you follow the system?

- What improvements can you make to the system to minimize these types of losses.

- Was your position size based off your calculation of risk percentage?

As long as you learn something from a loss, it’s not really a total loss. Think of the monetary aspect of a loss as the cost of tuition at the school of trading.

Losses aren’t the only mistakes

Missing an opportunity feels the same as being on the wrong side of a trade.

You’ll encounter this a lot. You find a great setup but still haven’t found your Confidence to execute the trade and you end up watching it play out exactly how you planned. This again comes back to Confidence. Now after this happens, the trader is usually overeager to make up for it and jumps on the next decent setup they see, but not making foolish moves such as these takes Discipline. See how this all comes together? They’re not two separate muscles to exercise individually but go hand-in-hand and must be trained in tandem.

The best trading plan in the world can’t work if you don’t act on it!

Key Points to Remember

- Emotions have no place in trading — Fear, Excitement, Anger, Greed, Bliss, Sadness — these all lead to foolish behavior.

- Calculate the maximum risk you can tolerate — and NEVER trade with money you can’t afford to lose or that will impact your life in the foreseeable future.

- Practice both the Discipline to sticking to your system and the Confidence that your system is sound.

- If you’re buying quality stocks, the price will never go to zero (at least not overnight… barring some massive corruption, it would take a while).

- In general, stock prices move UP over time (about 70% of the time). The Rolling Stones knew exactly what they were talking about — Time is on your side!

- You don’t always have to be in the market — Cash is a position!

- You can’t decide how prices move on a given day, but you can decide how you react (or don’t react) to them!

CLICK HERE to move on to Lesson 4: Using Indicators to Read Charts

Trade long and prosper.

🖖